Behavioral Finance 1st Assignment

11-02-2014

Content

Question 1 ....................................................................................................................................... 1

Question 2 ....................................................................................................................................... 1

Question 3 ....................................................................................................................................... 2

Question 4 ....................................................................................................................................... 2

Question 5 ....................................................................................................................................... 3

Bibliography .................................................................................................................................... 4

1 | P a g e

Q1) Describe the notion of the Disposition Effect. Which specific components of Prospect Theory

cause it, and which component(s) does (do) not have anything to do with it? Explain why.

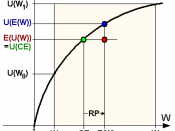

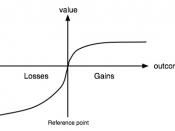

In Financial Behavior "Disposition Effect" is known as the predisposition to sell winner stocks too early

and cling unto their losers too long with the hope that the losers will in future perform better than

they are doing currently. People are generally risk averse but when people register losses, they are

more likely to gamble in order to reconcile with their losses and immediately sell when they register

gains for fear of losing. With the Prospect theory, utility is measured by gains over loses and not by

absolute wealth. People use their purchase price as reference point which is not so significant in the

Disposition effect.

Q2) There is much evidence that CEOs (or more generally, individuals that have attained high

positions in their careers) exhibit overconfidence. Give two different explanations for this fact. Can

it actually be rational (rather than a sign of biased beliefs) to take a lot of risk in the setting of job

promotion? Which is the aspect of job promotion that might encourage rational risk-taking?

2 | P a g e

Q3) Give a brief description (without equations) of the notion of the Winners Curse. Why is it a

curse? Or, in other words, why can it be bad news to learn that you are winning? We have

discussed the Winners Curse in the context of mergers and acquisitions in class. Does it apply to

other situations...