Needs some more interesting content Very good. Well organized

Bonds and The Bond Market

Given today's uncertain economy, many people are taking time to examine various options for their financial future. Different types of investments are investigated and bonds are one of the more popular choices considered. Many of the same people who talk about investing in bonds, however, do not fully understand them nor where they place in the economy. Many individuals believe that they should simply buy a bond and wait until it matures before cashing it in. These people fail to realize that they may be losing a lot of money due to the fluctuation of bond prices. At some point it may be more profitable for them to sell their bond than to keep it until the payment date is reached.

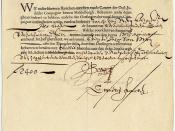

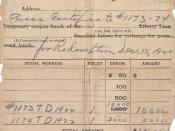

There are many people who do not understand what bonds really are. A bond is an agreement between two separate entities.

One of these bodies gives, to the other, use of their money for a period of time and, in return, may receive a 'bond'. The bond issuer agrees to a fixed rate of return which he will pay the supporting person or business. This fixed rate of return is an amount, in percentages, which is paid at regular intervals until some future specified time ( the 'maturity date'). Upon reaching the maturity date, one's original investment is returned to them.

As previously mentioned, bonds are one of the more popular types of financial investment in today's economy. There are many reasons why people invest in bonds. For example, if one chooses a stable and profitable bond, it will provide a steady source of income through interest payments during the lifetime of the bond. As well, the risk when investing in a bond is considerably...