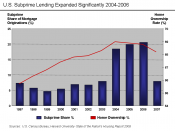

The Housing Market in California has been exploited and abused by the government, and Banks. People had made a huge profit of medium class working people by selling over priced properties, promising the American dream. However, a so call, bubble is bursting and a bubble can be defined as, "a price level that is much higher than warranted by the fundamentals" (dictionary.com). These bubbles occur when prices continue to rise for no other reason than investors believe these investments will continue to rise in value and subsequently be sold at even higher prices. There have been many debates for the past few years as to whether a bubble exists in the real estate market or if the market simply exhibits strong fundamentals. There have been countless books published on how to make money by investing in real estate and flipping properties, with only one published on "How to Profit from the Coming Real Estate Bust". Upcoming price corrections in the real estate market will have an impact on the entire economy as financial institutions become in danger of credit risks.

How all these people benefited from the outrages and criminal act of the California housing market? The Government never warned or did anything to prevent the abuse on the real estate market. The, State and Federal Governments could had regulated the sales of the homes based on the plus or minus percentage of the based appraisal price based on the National Market, and not based on demand and supply.

However, the local government and counties benefited from the abuse, of the overpriced housing as they collected huge profits on the sales and property taxes. However, the government benefits from the tax collection as has been spend back in to the communities, parks and maintenance of the county.

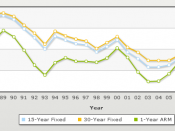

The Banks and financial institutions on their desperation and the opportunity to make money decided to have created finances with no income verification or complex teaser rates for individuals that could not really afford those over priced houses in the first place. Today the same Banks have either sold those loans, gone out of business or are taking huge losses on the same homes that they intended to make profits on. Mortgage brokers hire appraisers and Banks, so they are going to give the appraisals that mortgage brokers and Banks want to see, and not the truth. Appraisers that tell the truth do not get called back, to do other appraisals. The true damage from these new kinds of mortgages will come in time as interest rates rise. When the long-term interest rates begin to re-align with short-term rates the impact on prices could be devastating. Interest rate movements could force some homeowners into foreclosure as monthly payments have the ability to more than double with these "exotic", as Greenspan has described them, mortgages. This is also an opportunity for those investors or people that are looking for homes at a very reduced price. The tragedy of one family could be the opportunity for another one.

History has shown that as interest rates raises the demand on homes falls, and combined with current circumstances this is forcing home prices down, to some extent. Due to the cost related to the selling and buying of real estate, homes have never been considered very liquid. Currently, the situation is different though, with homes being bought and sold a number of times before the home is actually finished been built. As the liquidity that these investors are relying on to 'flip' their investments begins to drop with rising interest rates the investments will become less liquid, forcing prices to fall as investors attempt to unload their investments. The Banks, also allowed people a chance to obtain their dream home and it really was up to them change their financial position before the teaser rate would start.

The pricing madness was driving home prices up, and then becomes a meltdown of prices as investors attempt to unload those investments with fewer buyers. The problem lies on prices; they will not drop too drastically, as many current homeowners hope, and were looking to sell high and now they will simply take their houses off the market. Instead the prices are controlled by the fundamentals of a free economy, supply and demand. With demand being at all time high at the time, and an ever-increasing supply, many homes were build at record levels, today the market has to make correction on prices.

As shown in history the correction could take years and could simply be in the form of flat appreciation rates for the next decade, but the fundamentals suggest a more drastic correction. The large price corrections will be limited to the hot markets in which do not have the fundamentals to support such high appreciation. The impact though, will spread across the economy as the financial structure in which has been supporting these movements will begin to wobble. This also benefited many homeowners that took advantage of the housing booming and sold their homes making significant profits and perhaps moves to places more inexpensive such as Texas. Today many Americans live with financial freedom by simply been at the right place at the right time in the right situation.

Prices still disconnected from fundamentals. House prices are still much too high, far beyond any historically known relationship to rents or salaries. Yearly rents are 3% of purchase price. Mortgage rates are 6.5%, so it costs more than twice as much to borrow money to buy a house than it does to rent the same thing. Worse, total owner costs including taxes, maintenance, and insurance are about 9%, which is three times the cost of renting. Salaries cannot cover mortgages. Anyone who buys now will suffer losses immediately, and for the next several years at least, as prices keep falling. Anybody disagree? References: US Housing Crash Continues, http://patrick.net/housing/crash.html, retrieved February 15, 2008.

California's real estate Tailspin, http://www.time.com/time/business/article/0,8599,1647607,00.html, retrieved February 15, 2008.

Online Writing Lab, (2007). Grammar and Mechanics. Purdue University. Retrieved Jul 07 from: http://owl.english.purdue.edu/owl/resource/555/01/