Capital BudgetIn this document one will discuss the capital spending decision based on the simulation presented in the University of Phoenix web page, one will describe the different information used to evaluate the projects and the basis to the final conclusion.

Most companies to operate, plant, machinery and equipment are acquired to generate the services, products that eventually will be sold, from which the companies will generate revenues and more importantly wealth.

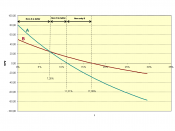

Capital investment is part of the normal processes carried by any company, because of various reasons, from limited resources to a broad diversity of projects; companies are obligated to decide which of various projects of investment they should support. Companies use various financial analysis techniques from DCF models, Internal Rate of Return (IRR) to determine which projects are expected to provide greater return to the company, therefore, resulting in wealth maximization.

In the scenario, Silicon Arts Inc. (SAI) has two important projects under analysis; only one of the two will be approved and carried out by the company.

SAI based on diverse information wants to know which of the two projects would be best to invest.

Basically, the first project is focused on expanding the existing digital image business (DIB); the second seeks to explore into a new market by entering into the wireless communication (WC) sector. Each project has its characteristics and risks, but for the sake of the capital spending decision, the base for the models of analysis are the expected inflows of cash during a period of time, the cash outflows and the expected cost of capital as the main three aspects to consider.

In the first section, one has to determine the cash inflows; using marketing research reports one was able to see estimate sales growth, market trend, period of time, and expected price...