The situation of the company

Ownership of the company

Members of the Verdin family combined owned 20% of the company's shares. Company executives combined owned 10% of the shares. Venus Asset Management, a mutual-fund management company in London, held 12%. Banque du Bruges dt des Pays Bas held 9% and had one representative on the board of directors. The remaining 49% of the firm's shares were widely held. The firm's share traded in Burssels and Frankfurt, Germany.

The composition of the company's main products & the allocation of the market

There are three main product categories in the company's precuts. Ice cream accounted for 60% of the company's revenue; yogurt, which was introduced in 1982, contributed about 20%. The remaining 20% of sales was divided equally between bottled water and fruit juices. These products were sold throughout Scandinavia, Britain, Belgium, the Netherlands, Luxembourg, western Germany, and northern France.

The current situation of the company

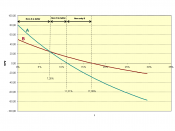

The company's sales had been static since 1998.

As claimed by the managers, this was partly due to the low population growth in northern Europe and market saturation in some areas. However outside observers faulted recent failures in new-product introductions. Now the company is at a debt-to-equity ratio of 125%, which is much higher than the average level of the company's peers in the European consumer-foods industry. This was caused by debt financing significantly in the past few years to sustain the firm's capital spending and dividends during a period of price war. Now the price war stopped with a result that the company's market value had been reduced by a great extent. The price-to-earnings ratio was 14 times, which is below the average multiples of peer companies and the average multiples of all companies on the exchanges where our company is traded. Since January 2000,