ACF IMT NAGPUR 2014

REPORT

Is American Home Products Corporation a growth company?

Ans. Yes, American Home Products Corporation is definitely a growth company because it has shown a stable and consistent growth over the last 10 years ranging between 10% and 15% annually (referring to Exhibit 1).

How much business risk does American Home Products face? How much financial risk would American Home Products face at each of the proposed levels of debt shown in case Exhibit 3? How much potential value, if any can American Home Products create for its shareholders at each of the proposed levels of debt?

Ans. A combination of business risk and financial risk shows the risk of an organization's future return on equity. Business risk is related to make a firm's operation without any debt, whereas financial risk requires that the firm's common stockholders make a decision to finance it with debt.

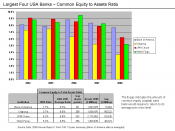

American Home Products has been operating on four main lines of business that are less uncertainty about product demand; for example, one of its business lines is food products because whenever people buy foods. It means that AHP's business risk is low. As mentioned above, if a firm does its operation activities regularly without leverage, it means that its business risk is not significant high. Thus, ratio of cash to total assets is calculated by following:

Figure 1 Proportion of cash and total assets, 1976-1981 ($ in millions) | ||||||

ã | 1981 | 1980 | 1979 | 1978 | 1977 | 1976 |

Cash | 729.1 | 593.3 | 493.8 | 436.6 | 322.9 | 358.8 |

Total Assets | 2,588.5 | 2,370.3 | 2,090.7 | 1,862.2 | 1,611.3 | 1,510.9 |

Proportion | 28.2% | 25.0% | 23.6% | 23.4% | 20.0% | 23.7% |

According to Figure 1, AHP's cash was about 23% of total assets, rose constantly since 1978 to 1981, and reached 28.2% in 1981; thus, it has enough cash flow to finance its daily...