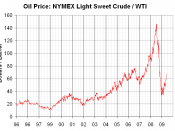

After 1980s, international finance market has high speed of development. Especially after 21 century, come out many different finance products on derivate market. From 2000-2005, total trade capital increase from $318 billion to $1,005,8 billion average growth rate of five years is 25.9%, and option market increase $66.4 billion to $402.6 billion, growth rate pre annual was 43.4%. (Contemporary finance & economics). Derivate products have both sides on the scale, in one hand; it might help company to hedging the risk. In other hand, it might push the company into finance problem. At the end of 2004, the China aviation oil corporations Ltd (CAO) trade option of oil and finally made lost of $554 millions.

This report are aim to disclose the reasons of why CAO making lose and give proper solution of using derivate tools to reduce risk. First section of this report will give briefly back ground information about CAO and oil industry.

Second section is going to give the concept of derivate tools and program which CAO used and how to push the company into problem. The third chapter is going to discuss the problems of why the company using wrong way of derivate toots and provide the better solution of how to use the derivate tools for case of CAO, it will also be provide other successful case in this chapter. The final chapter will give the evaluation and conclusion of this report.

LimitationThere are two limitations of this report show as follow:1 Time limitation: Time is limited for research2 Resource limited CAO did not disclose they annual report of year 20053 language translate Some critical evaluate are basic on Chinese language website, difficult to translate properly into English.

Chapter TwoCorporate backgroundChina aviation oil (Singapore) corporation Ltd (CAO) was incorporated in Singapore on 26 may...