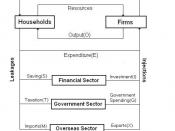

An accepted general model of economic behaviour in Macroeconomics is the Circular Flow of Income, which depicts a simplified view of how sections of the economy (output, income and expenditure) fit together.

Factors of production in the economy are generally categorised as land, labour and capital. Households are the ultimate owners of firms, therefore, it is accurate to say that households (people) sell their land, labour and capital to firms (producers) for which they receive income in the form of rent, wages and profit (dividends and royalties). Firms then use the factors of production to produce goods/services and sell them to households, who pay for them with their income. Money is normally exchanged for goods/services, therefore, as Figure 1 demonstrates, goods/services flow around the economy in the opposite direction to money.

Spending on goods/services

factor incomes (rent, wages, profit)

Figure 1

A closed economy only has two subsisting sectors, households and firms, however, an open economy must take external influences into account, such as government and financial institutions.

Figure 2 shows that:

çHouseholds save some of their income and it does not flow back into the economy automatically. This is termed leakage. Taxes are also a leakage.

çConversely, an injection is money which adds to the level of economic activity. Both government (not household) spending on goods/services and investments are injections. [Social welfare payments and similar government transfer payments do not add to the circular flow.]

IMPORTS (leakage) EXPORTS (injection)

Spending on goods/services

Figure 2

Figure 2 further demonstrates that an open economy must take foreign trade (exports and imports) into account. Households pay foreign firms for imported goods/services, indicating that imports are leakages. Foreign householders pay domestic firms for exported goods/services, indicating that exports are injections.

The National Accounts measure the value of total economic activity by estimating the...