Damon Hall Microeconomics April 2, 2002 Closing Bell The program I reviewed is called Closing Bell, on the date of April 2, 2002. It comes on at two o?clock and airs for CNBC every weekday that the markets are open. Some of the topics of discussion were obviously what happened in the market today, the levels they closed at, and the rising prices in commodities especially in crude oil prices. It also had a segment on the over all recovery of the market we are currently struggling against. A guest from the firm Brazo Funds, by the name of Michael Durante, spoke about the power of small cap growth funds and analyzed their recent market trends.

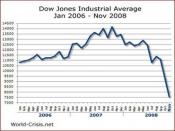

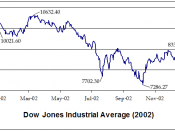

Today the Dow Jones Industrial Average closed down losing 48.99 points. It closed closely to the levels that it opened at this mourning. It didn?t wander into positive territory at all during the session.

The bulls were scared off today by rising oil prices in the market. Analysts blame the bear market on the fear of rising oil prices. This effects many industries, however the two biggest are the airline industry and manufacturing companies. The airlines have finally gotten people to start using air travel almost as often as they did before September 11th. Unfortunately with the current power of the crude oil price, they will have to raise air fare another 8%. This will probably result in less ticket sells, and lost revenue if the price of oil stays on the up climb. Manufacturing companies are suffering because they require oil for production. The energy levels needed to manufacture goods are extremely high, and they don?t have an alternative.

In addition to this fiasco, senior analysts from Goldman Sachs made statements that effect technology stocks. Most of these stocks are held in the NASDAQ. They Spoke harshly about some of the bigger names in this market such as Microsoft and Sun Microsystems. As a result many of the tech stocks took a beating making the NASDAQ closed down 58.22 points today. This is about 3%. To top it off stock advisors everywhere feel the reason that the markets have been struggling lately is because companies aren?t meeting their sales requirements. This is directly related to consumer confidence, which is currently near its lowest levels since February of 1994. People are afraid of losing their jobs, so they feel reluctant to spend money. Unemployment rates are still very uncomfortable, due to the fact that many Americans are still looking for work. Another thorn in the investment world is that there is talk of short turn interest rates moving back upwards.

A gentleman by the name of Michael Durante who is the Chief Quantitative Strategist for Brazo Funds, was on the show today. He stated that small cap growth funds are the way to go. They are up about 15% on the year, and are really wiping out the earnings of large caps. He feels that these smaller companies are still under valued and will continue to climb. His reasoning is that these smaller firms can adapt to demand more quickly than the already well established larger companies.

I spoke with a local broker named Dennis Hall and he seems to think that this isn?t necessarily true. He is more of a long-term investor and feels very comfortable with big names right now. He says high yield stocks are trading at ridiculously high levels, and this includes many small cap businesses. He stated that good, solid, well established companies such as the Blue Chips are not trading very high at all. He is of the opinion that investors are still swinging for the fences, for these second rate stocks. Some of which don?t have any earnings. Many of the big name stocks are not being bought at these current low levels. He is under the belief that investor?s feel these pretty much sure-fire investments yield too slowly. Inpatient investing is a bad way to earn money in my opinion. The market goes through trends and cycles. And if you are not patient you could pay a steep price. We just got out of the dot COM trend in 1999. Which happened to be the biggest market trend in 50 years. This is when the NASDAQ was at its highest point. The NASDAQ was priced at 5,050 points. If you look at today?s closing price of 1804, it will help prove the point. Many new investors don?t realize that 20 to 30 percent gains prior to this trend were abnormal to say the least. This is what professionals refer to as a market bubble. A trend that is hyped up tremendously, and comes crashing down. These companies that haven?t made any money are steadily going out of business, and it just isn?t a safe investment for consumers to make. The way to go, at least for now, is to snatch up some of these big name companies who have earnings. Especially while there at reasonably low prices. Some people really don?t care however if the company they are buying has made a dime or not.

This all depends on your point of view; weather you?re a fundamentalist or a technician. I tend to be more of a fundamentalist investor. These are people of the industry or basic investors that feel there are formulas and ratios to valuing stocks. The most basic measuring stick for fundamentalists is the price to earnings ratio, or P/E ratio. This is simply found by dividing the price of a particular stock by its companies earnings. There are several other pricing tools that fundamentalist exercise. Many of today?s brokers believe in this method. On the other hand there is a breed of investors that feel these fundamentalist techniques are obsolete. These people are classified as technicians or ?chartists.? They look at graphs and charts to evaluate a good buy or sell. They too have an array of theories in finding the value of particular stocks. These are the two most popular types of investing. Whichever type of system you follow, it is good that people disagree with one another. Other wise there would be no market. A difference in opinion is what makes a market a market. We studied this since the begging of microeconomics. It all goes back to the basic principals of supply and demand it is really that simple.

My over all assessment of Closing Bell is positive. The goal of the show is to sum up all the activity of the day in a couple of hours. This show is an effective tool if you want to have a market summary. Especially if you don?t want to watch or have time to see CNBC the entire day. They have an outstanding panel of reporters, and the guests of the show have the best credentials you can find. I observed that watching this type of program could give you broader knowledge of the stock market and current events as well. I feel that they could have summed most of the information up in a shorter amount of time, however the show isn?t catered just for my liking. I would recommend this show to those who like studying the market, economics, or people that have money currently involved in stocks or mutual funds.