When reviewing the Report of Independent registered public accounting firm for Coca-Cola Bottling Company (COKE), Price Waterhouse Cooper issued an unqualified opinion. The report from the independent registered public accounting firm is a statement signed by an independent public accountant describing the scope of the examination of an organization's books and records. Because financial reporting involves considerable discretion, the accountant's opinion is an important assurance to a lender or investor. The opinion can be unqualified or, to some degree, qualified. Qualified opinions, though not necessarily negative, warrant investigation. As I stated earlier COKE was issued an unqualified opinion. "The standard unqualified report is regarded as a clean bill of health, the auditor made no exceptions and inserts no qualifications in the report" (crfonline.org 5). The purpose of this audit is to hold COKE accountable for all the accounting figures that they present to their investors making a decision to buy or sell securities, the banker deciding whether to approve a loan, the person trying to make a decision to grant credit to the company and anyone who needs to use this information.

If there wasn't an external auditor, companies would cheat the system and lie about how much money they are really making.

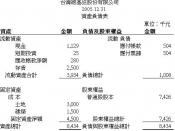

When looking at the annual report, the first financial statement that you will come across is the consolidated statements of operations. When looking at this statement an investor can see how much money was made just from operation activities. This statement will give you net sales, gross margin, income from operations, net income, basic net income per share, and diluted net income per share. This is an important statement because in order for a company to be successful in the long run, it must be making money from their operations. When reviewing COKE's statement of operations I...