2184465 Risk Management �PAGE � �PAGE �1� Treasury Risk Management

Currency and Interest Rate Swap

A Case Study of the Australian Foreign Exchange Market

Abstract

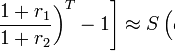

Business transactions occur on the international front and there are laws and regulations regarding the pricing of the long-term forward exchange contracts. It is noted that the violation of the traditionally covered interest arbitrage pricing relation has been rampant and that the activity in the international currency and interest rate swap markets offers a substantial explanation for the continued and prevalent wrong pricing. In essence, it will be clearly noted that the fixed-to-fixed currency swaps provide another form of arbitrage which can influence long-term forward exchange pricing.

This paper will discuss how the violation of the traditionally covered arbitrage pricing activity is always practiced by the international currency and the interest charge swap markets who are reported to be inappropriately placing the prices, the interest rate swap market is found to be providing some kind of arbitrages which actually affects the long term forward exchange pricing process.

The application of both the currency and the interest rate swaps providing a market for the bonds and contracts in the international market will be critically analyzed and discussed in this paper.

Introduction

A swap is always defined as an agreement made between two parties with an intention of exchanging a particular good, this good may be something of money value, we find under this agreement one party is always willing to make some payments for the good while the other one intends to purchase basing on some interests that are to be gained.

In this case we find that as from the year 2000 the swaps has been reporting a number of growth this coming up as a result their outstanding amount of the swaps in the...