Alcohol is categorized as a demerit good. A demerit good can be defined as a product, such as cigarettes, which consumers may overvalue and tend to over consume but which the government believes may be harmful for consumers. Demerit goods are those goods whose negative externalities are very high.

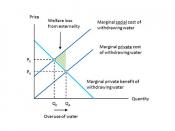

First, to be able to analyse whether the government should impose substantially higher levels of taxation on the sale of alcohol, we must determine the effect the tax will have on the consumption of alcohol and the change in the revenue made by the government by increasing the tax on alcohol. The following diagram illustrates the effect of additional taxes on alcohol:-

As the diagram shows the demand for alcohol is highly inelastic alcohol i.e. a change in the price of alcohol will result in a small change in the quantity demanded of alcohol. This is because a product like alcohol is addictive in nature.

When a tax is imposed on alcohol, it leads to a shift in the supply curve with supply decreasing from S1 to S2 and there is a considerable rise in price from p1 to p2. However, the drop in quantity demanded is relatively small with quantity demanded falling from q1 to q2. When taxes are imposed on a good, suppliers can choose to pay the taxes or pass it on to the consumers in the form of a price hike. They usually make this decision based on the elasticity of the demand. If the demand is inelastic, then the tax will be passed on to the consumers. As the diagram clearly illustrates most of the tax incidence falls on consumers- the portion that is shaded from p1 to p2. Suppliers also have to pay some of the tax but it is a very small part...