�PAGE � Dow Jones �PAGE �5�

Running Head: Week 1 Individual Assignment

Dow Jones Industrial Average

The Dow Jones average is a mixture of stock indexes which monitors 65 different companies in different sector. The Dow Jones industrial average is combination of large publicly traded companies and the most famous one in the media and gets a lot of attention from the viewers and investors. These companies are in different sector and they do fluctuate with the economy and the supply and demand. For instance the fluctuation of the oil stock in the past three years has been enormous as compare to a stock in food sector. These companies depend on the consumers, domestic economy and global economy

Share holders and public investors take advantage of different factors in economy and stock market. Increase in stock prices and decrease of market volatility. The greater emphasis is placed on the prices because investors do consider the price before selling or buying the stock.

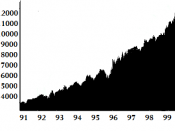

Votality is more in cycles due to the risk and uncertainty in the market. The difference between the Dow's high and low has been seen more in the past three years due to different factor in the US economy as well as the global economy. Some of these factors are the rising prices of oil, war, and the weakening US dollar in the market. in the past year the value of Dollar has dropped in comparison to the Euro. These could affect the companies operating internationally and would have a direct impact on the stock prices .The simplicity of the issue has to do with the most basic rule of economy.

The Rules of Supply and Demand

Market risk and volatility are interrelated in ups and downs and stock performances. As the risk increases, the uncertainty in the...