The critical problem faced by a firm in an oligopoly is that its decisions affect the prices and quantities of its rivals. The oligopoly problem arises because, where there are only a few suppliers to the market; the demand for the product of one firm depends significantly on the price and output. A non-cooperative duopoly is an industry consisting of two firms in which firms take their decisions independently and can be classified according to whether firms treat quantity or price as the key strategic variable. When it comes to quantity setting there are two major models put forward. The first, developed by Cournot in 1838 is based on firms setting quantities simultaneously where each firm is setting the output that maximises its profit given the output of its rival. In 1934 Stackelberg argued that one firm takes the role of 'leader' with the other firm acting as a 'follower' emphasising the quantity leadership view.

Here the leader anticipates the response of the follower and uses this to its own advantage.

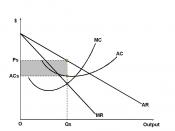

Bertrand in 1883 argued that price, not output, should be the firms decision variable where rivalry between the duopolists would result in both setting a zero price. Each of the models provides a different equilibrium output and welfare level

We assume a linear market demand curve, P(Q) which is given by a - Q where a is a positive parameter. Further we assume that all firms would incur the same constant per unit production cost, c, where c < a and for simplicity we follow Cournot in supposing that there are no costs of production (c = 0).

The Cournot model puts forward a case for simultaneous quantity setting where at the beginning of each period the firms take their decision independently and simultaneously. Here the profits of firm...