Introduction

Inflation, CPI

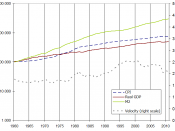

At the beginning of this year, a relatively low inflation was recorded, however, a somewhat higher inflation rates has been posted in the last five months as energy prices climbed upwards ("Consumer Price Index Commentary, 2004"). Canada's central bank has forecasted the inflation is expected to remain stable by the end of this year and well into the year 2005. The core inflation is seen falling below 1.5 per cent in the first few months of the year before moving back up to 2 per cent by the end of 2005. Furthermore, a 1.8% increase in this year's CPI is low and needs to be raised because of the unexpected increase in crude oil prices. The price index slightly dropped a little in June from the May high but even if it did not increase any further, the year- over-year increase would be almost 10%. The new forecast calls for a 2.2%

increase in Canada's all Items CPI in 2005 with a risk for a higher inflation rate (http://economics.cucbc.com/economics). In the Bank's April Monetary Policy, it expected core inflation to return to 2.0% by the end of 2005. The central bank has forecasted GDP will increase 3.2% in 2006. Both the goods and service producing sectors contributed to the GDP growth. Manufacturing activity was increase because of strong motor vehicle and motor vehicle parts production. Higher production of industrial machinery also contributed to the increase in GDP. Moreover, the retail activity grew by 1.1%. The wholesaling activity was up 0.8% as a result of the surge in sales of cars and machinery.

If the CPI rises then the price of new vehicles might increase as well. That might impact on the consumer purchasing power. The CPI also reflects the "oil shock" preference for smaller, economical cars...