Question 1

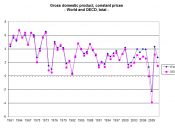

In their paper on U.K. monetary policy and EMU entry, Kontolemis and Samiei

(2000) begin by observing the differences in the business cycles between the EU

economies and that of the UK. The cycles in the UK are different from the continent

because of "different policies or exogenous variables, different transmission mechanisms,

and different idiosyncratic shocks" (Kontolemis and Samiei 2000, p. 3). For example,

the UK business cycles tend to be a bit more volatile and long lasting in comparison to

the continent. The 1990-93 recession lasted eight quarters in the UK compared to four in

Germany and five in Italy. The variance of rates of GDP growth is significantly higher in

the UK than in France, Germany, and Italy. After noting the differences in the economies

between the UK and the rest of Europe, Kontolemis and Samiei used VAR models to try

to see if the UK business cycles could become more synchronized with Europe if they

allowed for the European Central Bank to run their monetary policy.

Kontolemis and Samiei's monetary policy model used six variables: money, GDP,

domestic nominal interest rates, foreign nominal interest rate, real effective exchange

rate, and inflation. They estimated a system of cointegrated structural VAR's in order to

assess the contributions of monetary policy and the exchange rate to the business cycle in

the UK. Kontolemis and Samiei (2000) identified three relationships and tested to see if

they were valid:

(1) In the money market, the exogenous stock of money is equal to long-run

money demand, which is expressed as a function of income and the interest rate;

(2) In order for there to be perfect capital mobility there must be equal domestic

and foreign interest rates;

(3) How the actual output of a country will deviate from its potential is...