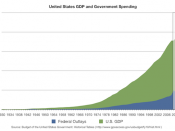

The new economic policy of the united states should

include cutting taxes, reducing governmental waste, and

balance the budget by having a smaller more efficient

federal government. It should include equal opportunity for

financial security but not through a government sponsored

redistribution of wealth program.

Cutting taxes across the board including income tax

rates, capital gains and estate taxes among others should

provide a growth spurt for the economy. Allowing people and

businesses to keep more of their hard earned money would

enable them to spend more money. People would be able to

buy more cars, refrigerators, homes etc. The businesses

would be able to build new factories with better more

efficient high tech equipment. These new factories and

expanded businesses would employee more highly paid workers

which would expand the tax base and allow us to be more

competitive in the world marketplace.

Reducing the taxes would also motivate people to work

harder and save more.

The way things are now people can not

seem to get ahead no matter how hard they work. The harder

they work the more the government takes while others who

choose not to work hard or have not developed the skills to

earn a decent wage reap the same and in many cases more

benefits. For example student loans and grants for college

board and tuition fees are largely unavailable to lower

middle class families let alone middle and upper middle

class people. Reducing taxes on businesses would also allow

them to invert more on new product development and research

which in many instances the federal government now

subsidizes which requires management. This government

management bureaucracy cost tax payers money and is

unnecessary because free market demands and the extra money

they would save from tax cuts would motivate businesses to

fund these...