IntroductionThe Federal Reserve (Fed) and monetary policy -- two names that go hand-in-hand in the controlling of money supply to influence interest rates and assist the economy in achieving price stability, full employment, and economic growth. This paper will go into detail analyzing the creation of money and the tools the fed uses to control/influence money supply, monetary policy and impacts. Step one, of course, is the creation of money in the first place.

Money CreationMoney is defined as any item that is generally acceptable to sellers in exchange for goods and services, (McConnell and Brue, 2004). Money also serves as a standard of value for measuring the relative worth of different goods and services and as a store of value. Money is normally the standard of deferred payment (to settle a debt). To the uninformed, money is strictly currency; however, money can also be in various forms of financial deposit accounts, such as demand deposits, savings accounts, and certificates of deposit.

In modern economies, currency is the smallest component of the money supply. Money is not the same as real value, the latter being the basic element in economics. Money is central to the study of economics and forms its most convincing link to finance. The absence of money causes an economy to be inefficient because it requires a coincidence of wants between traders, and an agreement that these needs are of equal value, before a barter exchange can occur. The efficiency gains through the use of money are thought to encourage trade and the division of labor, in turn increasing productivity and wealth, (Wikipedia, 2007).

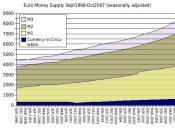

Money creation is the process by which the money supply of a country is increased. Government has several ways, in coordination with the country's commercial banks, to increase or decrease the money supply...