TABLE OF CONTENTS

iLIST OF TABLES �

1INTRODUCTION �

31. HISTORICAL EVOLUTION OF THE EUROPEAN ECONOMIC AND MONETARY UNION �

31.1. A Brief History of European Economic and Monetary Integration �

41.1.1. European Payments Union (EPU) �

51.1.2. Three European Communities �

71.1.3. Collapse of the Bretton Woods System �

91.1.4. The European Monetary System (EMS) �

121.1.5 The Dellors Report �

131.2. The Maastricht Treaty �

161.2.1. The Convergence Criteria and Budgetary Discipline �

192. MONETARY POLICY STRATEGY OF THE EMU �

192.1. Open Market Operations �

202.2. Standing Facilities �

202.3. Minimum Reserve System �

212.4. Key Interest Rates �

223. MONETARY POLICY IN TURKEY �

223.1. 1980 Stabilization Program �

233.2. 1994 Stabilization Program and the 16th Standby Agreement �

253.3. 1998 IMF Staff Monitoring Programme �

253.4. 1999 Program and the 17th Standby Agreement �

273.5. Pre-crisis economic situation in Turkey �

293.5. Economic Crisis of 2000-2001 �

303.6. Strengthening the Turkish Economy and the 18th Standby Agreement �

333.7. Inflation Targeting Strategy and the 19th Standby Agreement �

35CONCLUSION �

�

LIST OF TABLES

20Table 1 Conversion Rates between the Euro and the Euro Area Countries �

23Table 2 Monetary Policy Strategies �

33Table 3 Inflation Rates and Growth Rates �

35Table 4 Main Fiscal Indicators, % of the GNP �

�

�

INTRODUCTION

The European Economic and Monetary Union (EMU) represents a unique experience in history. The Stability and Growth Pact (SGP) and the monetary policy strategy, which form the macroeconomic policy framework of the EMU, create new economic problems required to be analyzed.

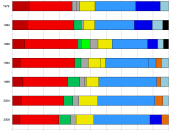

By the start of the EMU on 1 January 1999, eleven European Union (EU) countries launched a common currency, the euro. Greece joined the euro area in January 2001. The euro notes and coins replaced the national currencies...