Introduction

Wheybridge Ltd has developed a new product- the printer, which has great potential, can be sold to all computer users. However, the sales would exceed the existing capacity. Wheybridge has to develop its own delivery, recruit staff and purchase vehicles. Therefore it is necessary to budget the investment amount and analyze available finance sources to invest this project. Moreover, with the aid of investment appraisal, managers should make a decision whether to invest the project and anticipate the profits and risk.

1. Investment Budget

1.1 Investment Budget of Fixed Asset

The fix asset investment includes plant constructing, vehicles purchasing and staff training. The table below shows the composition of fix asset investment:

Num. Item Amount( ) Percentage in total fixed asset investment %

1 Constructing 1,500,000 50%

2 Vehicles purchasing 100,000 33.3%

3 Staff training 40,000 13.3%

4 Provision 10,000 3.3%

5 Investment on fixed asset 3,000,000 100%

1.2 Investment Budget of working capital

"Working capital is defined as the difference between current assets and current liabilities."(Jaffe, Ross and Westerfield, 1998) It must maintain an investment in working capital. The calculation of working capital adopts subentry calculation method. According to the forecast of production, inventory, sales, and referring to the average working capital in the printer industry , the working capital of this project is approximately 1,000,000.

1.3 Total Investment Budget

Total investment = Investment of Fixed Asset + Investment of working capital

= 3,000,000 + 1,000,000

= 4,000,000

2. Finance of the Project

There are various sources of finance for the company. The source of finance should be chosen according to the situation and features of the project. Four sources of finance can be adopted for Wheybridge Ltd. They are retained profit, bank loan, ordinary shares and venture capital.

2.1 Internal sources of finance

Retained profits

Retained profits are the main source of finance for the company. "The reinvestment of profits rather than the issue of new ordinary shares can be a useful way of raising equity capital. There are no issue costs associated with retaining profits, and the amount raised is certain, once the profit has been made." (Atrill and McLaney, 1998) Moreover, retained profits are owned by the company, it is can be used without waiting for receiving funds.

In the fierce competitive business environment, time is valuable for a new product. Successful companies always lead their competitors. Wheybridge retained profits are1,000,000, which is not enough to support this project, but it is can act as start-up funds. Meanwhile the company should seek for other finance sources.

2.1 External sources of finance

Bank loans- short-term finance

"The simplest and most common source of short-term finance is an unsecured loan from a bank. The firm can borrow and repay whenever it wants so long as it does not exceed the credit limit."(Brealey, Marcus and Myers, 1991) The line of credit of Wheybridge is

1,000,000. Atrill and McLaney explain the advantages of bank loan to us:

Bank overdrafts represent a very flexible form of borrowing. The size of an overdraft can (subject to bank approval) be increased or decreased according to the financing requirements of the business. It is relatively inexpensive to arrange, and interest rates are often very competitive, the rate of interest charged on an overdraft will vary, however, according to how creditworthy the customer is perceived to be by the bank. It is also fairly easy to arrange- sometimes an overdraft can be agreed by a telephone call to the bank. In view of these advantages, it is not surprising that this is an extremely popular form of short-term financing.

Ordinary shares- long-term finance

"Ordinary shares form the backbone of the financial structure of a business" (Atrill and McLaney, 1998) "When the firm borrows, it promises to repay the debt with interest. If it doesn't keep its promise, the debtholders may force the firm into bankruptcy. However, no such commitments are made to the equityholders. They are entitled to whatever is left over after the debtholders have been paid off." (Brealey, Marcus and Myers, 1991)

"From the business's perspective, ordinary shares can be a valuable form of financing, at times, it is useful to be able to avoid paying a dividend. In the case of new expanding business or one in difficulties, the requirement to make cash payment to investors can be real burden. Where the business is financed totally by ordinary shares, this problem need not occur." (Atrill and McLaney, 1998) On the other hand, shareholders have the control over the business's affairs. When companies make decision or take action, they should receive the shareholder's approval. For example, shareholders have right to vote on appointments of the board directors.

A public issue of shares may be costly, but it would benefit the company's long-term goal- maximizing the shareholder's wealth. For Wheybridge, because it has existing shares in public, the right offering is suggested in this situation. A right offering is "an issue of common stock to existing stockholders." (Jaffe, Ross and Westerfield, 1998) Shareholders can maintain their rights or sell them. Apparently, the new price of the company's stock will lower after the rights offering. However, our shareholder would not suffer this loss. Wheybridge can obtained 1,700,000 through right offering.

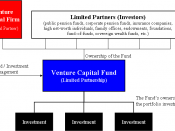

Venture capital- long-term finance

"Venture capital is long-term capital provided by certain institutions to help business exploit profitable opportunities." (Atrill and McLaney, 1998) The venture capital investment is high-risk investment. "It is not passive portfolio investment but involves a close working relationship between the venture capital company and the company receiving the funds."(Brayshaw, Samuels and Wilkes, 1995) Usually, the venture capital company will appoint a representative in the broad of directors so as to monitor the investment.

Wheybridge's new product has a great market potential. It might give high return to the shareholders. This is a most attraction for the venture capitalists that are usually looking for an average return of 35% per annum on their investment. (Brayshaw, Samuels and Wilkes, 1995) Furthermore, venture capital company usually interested in the small or medium size business. Therefore this project might receive funds from the venture capitalist.

"The 3Is, the largest venture capital operation in the UK, will invest funds from 5000 up to 2 million." (Brayshaw, Samuels and Wilkes, 1995) This project is probably receive 300, 000 investment from the venture capitalist.

2.4 Structure of fiancé

3. Investment Appraisal

The investment decision is crucial to the success of the company. "Investment involves making an outlay of something of economic value, usually cash, at one point in time that is expected to yield economic benefits to the investor at some other point of in time."(Atrill and McLaney, 1998) In order to help Wheybridge Ltd making decision to invest in the new printer project, some method of appraisal is set out "which can be applied equally to the whole spectrum of investment decisions and which should, in terms of the decision structure so far outlined, help to decide whether any particular investment will assist the company in maximizing shareholder wealth."(Lumby, 1991) there are five main methods for the company to evaluate investment opportunities. They are accounting rate of return (ARR), payback period (PP), net present value (NPV), internal rate of return (IRR) and sensitivity analysis.

3.1 accounting rate of return (ARR)

"This method takes the average accounting profit which the investment will generate and expresses it as a percentage of the average investment in the project as measured in accounting terms. Thus,

ARR= Average annual profit division Average investment to earn that profit ÃÂ100% "

(Atrill and McLaney, 1996)

After calculating ARR of the new printer project, the comparison should be made with a minimum require rate set by the Wheybridge company. The evidence shows this project is far exceeded the minimum rate. According to Atrill and McLaney, "where there are competing project that all seem capable of exceeding the minimum rate, the one with the highest ARR would normally be selected."

ARR is regarded as one of main method of investment appraisal because of its two advantages. First, it is a holistic approach to evaluate the performance of investment. Second, "ARR is also a measure of profitability that many believe is the correct way to evaluate investments, and it produces a percentage figure of return which managers understand and feel comfortable with." (Atrill and McLaney, 1996) But it is necessary to point out that ARR ignores the time factor, which is more important factor for the investment decision.

3.2 payback period (PP)

"The payback period for an investment is the number of years required for the undiscounted sum of the returns at least to equal the initial outlay- in other words to pay it back." (Brayshaw, Samuels and Wilkes, 1990) "In times of cash shortage this may be of vital importance to the business."(Searle, 2000)

PP method is easy and quick way to calculate. The payback period can be obtained by calculating the cumulative cash flow. For this project we can see the cumulative cash flows become positive by the end of the third year. Thus the project's PP is 3 years. Compared with the company's minimum PP that is 3.5 years. This project is acceptable. "The PP method is not concerned with the profitability of project", but it "does at least provide a means of dealing with the problems of risk and uncertainty." (Atrill and McLaney, 1996)

3.3 Net present value (NPV)

"A more reliable method is to consider the project's net present value. The net present value is arrived at by 'discounting' all the cash flows associated with the project."(Hatherly, 1993) NPV "takes accounts of all the costs and benefits of each investment opportunity and that also makes a logical allowance for the timing of those cost and benefits." (Atrill and McLaney, 1996) There are four steps to calculate the NPV (Brealey, Marcus and Myers, 1991):

Step 1. Forecast the project cash flow.

Step 2. Estimate the opportunity cost of capital.

Step 3. Use the opportunity cost of capital to discount the future cash flow.

Step 4. Go ahead with the project if the present value of the payoff is greater than the investment.

NPV=PV- required investment

In this project, the discount rate is 10%. Therefore after calculating NPV is greater than zero. The positive NPV indicates that the investment would increase shareholder's wealth. Therefore it would be acceptable.

3.4 internal rate of return (IRR)

The IRR is a discount rate at the point where NPV equals zero. The IRR of this project can be seen on the figure below:

Net present value

000,000

Discount rate

The IRR indicates to accept a project when the rate of return exceeds the opportunity cost of capital. From the above figure, we can see as long as the opportunity cost of capital is less than the project's % IRR, the project has a positive NPV. "In fact the rate of return rule will give the same answer as the NPV rule as long as the NPV of the project declines smoothly as the discount rate increases." (Brealey, Marcus and Myers, 1991)

3.5 Sensitivity analysis

"If this NPV is positive then the appraisal is in favor of acceptance. But in terms of down-side risk, the decision maker is also interested in how sensitive the advice is to the estimates made about the project."(Lumby, 1991) In sensitive analysis the zero NPV becomes the decision pivot point. The sensitivity factors of this project shows below:

Sensitivity table

Variable Original EstimateMaximum ValueMaximum ChangeChange %

Outlay 4,000,000------------------------------------

Life 10----------------------------------------

Revenues 2,000,000-------------------------------

Costs 1,500,000---------------------------------

Discount Rate 10%----------------------------------

From the table, the main factors affecting this project have been examined. The change percentage indicates the margin of safety for that factor. These figures shows margin of safety is reasonable. The project is not a high risk investment. "Sensitivity analysis technique is a good working tool in that it makes the decision maker more aware of the possible effects of uncertainty on his investment decisions. In addition, it can also help to direct attention to those particular estimates, which require a special forecasting effort on account of their effect on the decision's sensitivity. (Lumby, 1991)

Conclusion

Wheybridge's new project requires investment of 4,000,000. The company can finance this project from four sources- retained profits, bank loan, ordinary shares and venture capital. The retained profits can provide 1,000,000 as a start-up funds. Meanwhile the company can obtained the money from bank loan for 1,000,000. The amount of ordinary share and venture capital is 1,700, 000 and 300, 000 separately. The investment appraisal shows the project is profitable and lower risk because of short pay back, positive NPV and higher margin of safety. All evidences indicate the project is feasible investment.

Reference

Atrill,P. and McLaney E. (1996), Accounting and Finance for non-specialists, (2nd, edn), Prentice Hall, Europe.

Atrill,P. and McLaney E. (1998), Accounting: An Introduction, (1st, edn), Prentice Hall, Europe.

Brealey,R.A., Marcus,S.C. and Myers,A.J. (1991) Fundamentals of Corporate Finance, McGraw-Hill, New York.

Brayshaw,R.E., Samuels,J.M. and Wilkes,F.M. (1990), Management of Company Finance, (5th, edn), Chapman and Hall, London.

Brayshaw,R.E., Samuels,J.M. and Wilkes,F.M. (1990), Management of Company Finance, (6th, edn) Chapman and Hall, London.

Jaffe,J.F., Ross,S.A. and Westerfield,R.W. (1998), Corporate Finance, (2nd, edn), Irwin, Boston.

Hatherly,D.(1993), Accounting for Business Activity: Case scenarios in accounting, Pitman, Glasgow.

Lumby,S.(1991), Investment Appraisal and Financial Decisions, (4th, edn), Chapman & Hall, London.

Searle,D.(2000), Accounting and Finance for Managers: An MSc Study Guide, University of Hull, Hull.