INTRODUCTIONThis paper aims at introducing and describing Venture capital, stages of VC, importance in economic growth and lastly valuation of new business ventures. There are several financial methodologies available for valuing new business based on its outputs such as cash flows, financial statements etc. This paper introduces a complementary method to existing financial methods to valuate new venture. This is based on a research study paper "New Venture Valuation by Venture Capitalists: An Integrative Approach" published by Dingkun Ge (Asst. Prof. San Francisco University), James M. Mahoney (Economist, Federal Reserve Bank of New York) and Joseph T. Mahoney(Prof. of Strategic management, University of Illinois at Urbana). The research study develops a theoretical framework to explain the relationship between venture capitalists' valuation of new venture and factors identified in the strategy literature as important in predicting a firm's economic performance.

VENTURE CAPITALKeeping a business going takes money and growing it can take even more.

Capital is the life blood of a growing business. There are several different ways to raise capital to fund the growing business. The success of these strategies depends on the stage of growth of the business and the current trend of the industry in which the business operates. Raising finance for a business is often a complex process. Funds can be raised by using personal savings, boot strapping, bank loans or through Private equity.

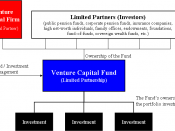

Venture capital is a type of private equity, which is a term that encompasses a broad range of equity investments in private businesses. Private equity firms are frequently categorized into three types - venture capital, mezzanine (also called expansion), and buy-out (also called leveraged buy-out) - classified according to factors such as industry expertise, investment levels, deal structures, and desired return1. There is some overlap amongst the three types of private equity...