A Balance Sheet is to show at a point in time of what the business owns (its assets) and what it owes (its liabilities). An Income Statement is to show how successful the business performed during a period of time. The income statement would show the revenues and expenses and the profit. Retained Earnings Statement is to show how the previous income was distributed to the owners of the business in the form of dividends, and how much was retained in the business to allow for future growth. A Cash Flow Statement shows what sources the business obtained cash during a period of time and how that cash was used.

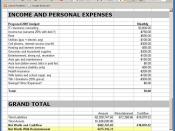

The company uses the income statement to report the success or the failure of the companyÃÂs operations for a period of time. The Income Statement is used to evaluate if the company is profitable. Investors look at the income statement in the companyÃÂs past net income to provide information for future net income.

Managers of the company use the income statement to forecast their revenues and expenses. Retained Earnings statement is retained profits that the company would like to have for further expansions or investment opportunities. Companies use the Retained Earnings Statement to see the companyÃÂs policy toward dividends and growth. Also to see how much dividends was paid out. If a company is striving for rapid growth will pay low or no dividend.

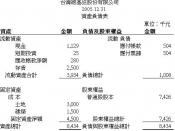

Managers of the company use the balance sheet to determine where inventory is adequate to support future sales and whether cash on hand is sufficient for immediate cash needs. Managers look relationship between debt and stocklholdsÃÂ equity to determine where they have the best proportion of debt and common stock financing. The Companies use the Cash Flow Statement to find information about the cash receipts and...