An analysis of Riordan manufacturing financial system

Riordan Manufacturing is a manufacturing company using state of the art technology to create innovative plastic designs which has earned the company international recognition. The company is know for it extreme precision and quality, and has generated different location in the US, China, and San Jose.

Riordan Manufacturing is a Fortune 1000 company owned by Riordan with annual revenue in excess of 1 billion dollars. The research conducted for the company is located at the corporate head quarters, which is San Jose. Riordan's major customers are automotive parts manufactures, aircraft manufacturers, the Department of Defense, beverage makers and bottlers, and appliance manufacturers. Riordan has three operating entities, California, Georgia, and Michigan, each having its own Finance and Accounting department. Each department provides input to the corporate head quarters in San Jose and as a result, Riordan has been able to maintain good customer relations due to its rigorous quality controls, innovative solutions, a responsive business attitude and reasonable pricing.

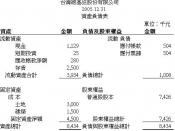

Income Statement

The primary purpose of the Income statement is to report a company's earnings to investors (internally or externally) over two or more years (Income statement analysis, 2007). By no means is Riordan Manufacturing any different, the income statement that it has provided shows two years of income and expenditure. This will show how effectively management is controlling expenses, the amount of taxed paid and the amount of interest income.

In the year 2005 Riordan had an increase of over $4 million in sales. The Cost of Goods sold also increased giving them a gross margin increase from $8,564,238 to $8,786,061. Operating expenses also increased thus making their profit before taxes to fall off by about $200,000. In the previous year profit before taxes was $3,246,122 but in the next year it decreased...