Companies with significant overseas exposures need to understand their foreign exchange risk to ensure it is effectively managed in order to increase firm value by reducing indirect costs of financial distress and stabilize cash flows to increase debt capacity and avoid external financing. Foreign exchange risk is the risk that foreign exchange unanticipated fluctuations will affect the firm's cash flows, balance sheet values and market value.

There are three types of foreign exchange exposure: transaction exposure, translation exposure and economic exposure. "Transaction exposure is the risk that a firm's net cash flow will be diminished by changes in the exchange rate in which transactions are denominated". Translation exposures relate to foreign currency assets and liabilities, overseas operations and subsidiaries. The third type of exposure is economic exposure which is a more long term exposure and represents the economic effect on the value of a company from long-term movements in one or more foreign currencies.

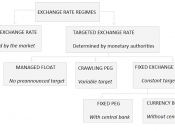

"Exposure alone does not justify hedging. However, the risk associated with a particular exposure may be sufficient to justify hedging." This means these financial risks do threaten a firm even it is being well run. Therefore, there is foreign exchange risk management dealing with it. Economic theory defines foreign exchange risk management as "the process whereby a prudent person first ascertains the acceptable level of risk, then estimates the actual level of risk, and then tries to adjust the actual level of risk to match as closely as possible the acceptable level of risk. This process is also referred to as hedging, risk reduction, and in some cases, even risk elimination". It involves internal and external hedging strategies. The general recommendation is to avoid external hedging approaches, which embracing forward, future, money market hedges and so forth, because it does cost such as premium, tax etc.

A+

very informative and written splendid

0 out of 0 people found this comment useful.