University of PhoenixMarch 13, 2006FIN 325IntroductionDetermining whether leasing or buying is better economically (known as lease vs. buy or lease vs. purchase analysis) requires knowing the purchase cost of the asset, the rental costs, the interest rate on a loan if you borrowed to buy the asset (or the cost of capital if you pay cash), and the expected value of the asset at the end of the lease term, known as the residual value. The cash flows for both leasing and buying are compared, with future payments discounted to reflect the time value of money (i.e., $1 two years from now isn't as valuable as $1 today, since interest can be earned between now and then), and with the tax effect of deductible expenses calculated. Tax calculations are complicated by the fact that the determination of whether a lease is operating or capital for tax purposes (called by the IRS a "true lease" and a "conditional sales contract," respectively) is not always the same as the determination for book purposes.

(http://ez13.com/leasebuy.htm)Risks and UncertainiesLeases take into account that the equipment is worth something at the end of the lease term. This is called the residual value. Residuals are built into lease pricing, usually making the lease payments lower than a loan. To compare leased products, it is better to compare monthly payments than to try to compare loan interest rates with lease rates. On a cost-of-capital basis, leasing may be the least expensive option.

Some leasing companies can offer competitive rates for a number of reasons. LessorsÃÂwith their close ties to equipment manufacturersÃÂmay offer attractive financing and pass along the savings to the lessee. The lessor also is better able to take advantage of the deduction for depreciation expense that comes with ownership. Once you have completed your evaluation and decided to lease your next equipment acquisition, the first step is to select the type of lease that fits your needs. You also will need to determine what happens at the end of the lease. Your options can include returning the equipment to the lessor, purchasing the equipment at fair market value or a nominal fixed price, or renewing your lease. Leasing is good business because you rely on equipment every day to operate and grow your business. But the value of that equipment comes from using it, not owning it. By leasing, you transfer the uncertainties and risks of equipment ownership to the lessor, which allows you to concentrate on using that equipment as a productive part of your business.

Present Value of OutflowsIn selecting the purchase option the company will have flexibility and able to upgrade the plant and carry out a sale and lease back transaction in the future. The cash benefit from this cash outflow will be there for future cash problems. So the asset of the company will actually make the company money during times of needs.

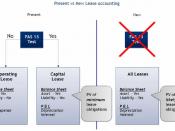

Capital & Operating LeaseA capital lease is ideal when long-term ownership of the asset is the goal. Capital lease allows businesses to write off up to $100,000 of equipment in the year it is purchased. On the other hand, an operating lease is ideal when use, not ownership, of the equipment is important. Operating leases typically have fair-market-value buyouts in which ownership is negotiated at the end of the lease. You are able to write off 100% of each monthly lease payment.

BonnesanteÃÂ would benefit from either the operating or capital lease in the instant because at this point they could utilize their asset from the company.

Qualitative FactorsThe decision to lease or buy an asset with borrowed funds depends upon which alternative has the lower present value of after-tax costs. If funds are borrowed to purchase an asset, the tax shield provided by interest expense and depreciation should be considered in the lease/buy decision. If an asset is categorized as an operating lease, the tax-shield due to lease expense should be considered in the lease/buy decision.

ConclusionIn conclusion, BonnesanteÃÂ would benefit more with the option of buying the spectrometer. Since the asset is required for a long term and there is no threat of obsolescence the company could utilize the asset for its entire economic life, which would be approximately five years. There are many pros and cons to both leasing and buying it is what would be beneficial to that company at that time that would work in the company favor.

References:When to lease, when to buy. (2006). Retrieved on March 13, 2006, from the World Wide Web: http://www.http://ez13.com/leasebuy.htm