Introduction:The General Appliance Corporation is a manufacturer of all types of home appliances. The company has a decentralized, divisional organizational structure, which consists of four product divisions (electric stove, laundry equipment, refrigeration and miscellaneous appliance division), four manufacturing divisions (chrome products, electric motor, gear and transmission and stamping division) and six staff offices (finance, engineering, manufacturing, industrial relations, purchasing and marketing staff). The staff offices do not have functional authority over the divisional general managers, who are each responsible for their own divisional personnel. The manufacturing division made approximately 75 percent of their sales to the product division. In addition, the parts made by the manufacturing division is designed and engineered by the product divisions. Since the eight divisions are expected to act like independent companies, the transfer prices are negotiated amongst themselves. But, if two divisions could not agree on a price, they submit the dispute to the finance staff for arbitration.

The product division does not have the power to decide whether to buy from within the company or from outside. If there was a disagreement with the sourcing, the manufacturing division could appeal to the purchasing staff to reverse the decision.

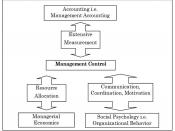

Problem:At the General Appliance Corporation, the purchasing staffs are the personnel that decide which part would continue to be manufactured within the company (org. chart may need to be revised). When the part is decided to be manufactured internally, the manufacturing division must hold the price at a level the product (purchaser) division could purchase it outside. Currently, the managers do not have the freedom to source and choose the alternative that is in their best interest, even though an alternative for sourcing does exist.

The three problems that exist in the company are:-Determining a transfer price that includes the extra $0.80 per unit spent on...