IntroductionIn this paper, will describe and analyze hard and soft currencies and how they are used in global financing operations. We will also describe their importance in managing risks.

Hard and Soft CurrencyHard currency is the currency that is backed by gold reserves and is readily convertible into foreign currencies. (Infoplease.com, 2006) This means that hard currency is a currency that is a stable standard of exchange and security. The main global hard currencies are the U.S. dollar, Swiss franc, Deutschemark, and Japanese yen. Each of the previously listed currencies is backed by a gold reserve, making them a stable standard of exchange.

Soft currency is a "currency from a country that is not economically and politically stable, or in which there is not widespread confidence in the exchange rate. The governments of such countries set an unrealistically high exchange rate, and the exchange rate is not backed by gold."(Dictionary

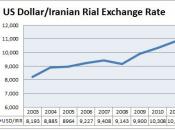

of Small Business, 2003)EXCHANGE RISKUncertainty will likely come to companies which make international investments when they exchange their gains for their own currency. In the past, many U.S. investors left behind other choices of international investing. Today, international investors ought to foresee and comprehend the exchange rate risk, which can be described as the flippancy in returns on securities caused by currency changes. Currency risk is another term for exchange rate risk. This risk is true for the nations also. For example, free-floating currency nations' exchange rates are permitted to fluctuate compared to the rates of other nations' currencies. Thus the exchange rates for free-floating currency nations are apt to fluctuate quite often as reported by many banks and financial institutions around the globe. This can lead to lot of speculation and losses especially for countries with weaker economies.

MANAGING RISKTo avoid foreign exchange risks the nations or organizations...