The price mechanism plays an important role in resolving the economic problem of unlimited wants versus limited resources in a market economy. Left alone to function the market can create less than satisfactory outcomes with equilibrium prices or quantities being either too high or too low. The government has many powers it can exercise to intervene and move the market to a point that it considers more satisfactory to the economy. Some of the governmentÃÂs powers include putting in place a ceiling or a floor price, increase taxes such as excise duty, restricting the number of suppliers in a market or provide incentives to encourage new suppliers to enter the market. All these controls apply to different situations and when used properly give the government considerable power over the market.

A floor price is the minimum set price that a supplier can charge for a product. It is designed to protect a producer by guaranteeing them a minimum price for their products.

This is achieved by artificially preventing the price of the product from falling below a minimum threshold.

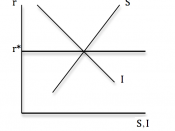

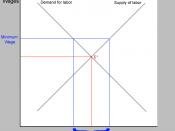

Diagram showing implementation of a price floor.

Note the surplus of 6 units created from a floor price set at $8 against a market price of $5.

Also note the floor price set below equilibrium and how it has no effect on the market as it clears at the equilibrium price of $5 where supply equals demand.

Price floors are often implemented in the agricultural market in an effort by the government to give farmers a satisfactory return. The agricultural market can be erratic due to the seasonal nature of the goods produced, effects of weather, pests and natural disasters, oversupply from cheaper imports, and higher costs due to extreme weather patterns such as the recent drought. The government chooses to intervene in the agricultural market in order to assist farmers by raising the price to a point where they can earn an income that is sufficient to allow them to survive. A floor price in this market also creates more jobs as producers are able to cover the costs of hiring additional staff. For example the US government guarantees its wheat farmers a minimum price for their produce. The US government offers to buy any surplus that cannot be sold by the wheat farmers at the floor price.

The government also uses price floors in the labour market. In an effort to cut costs, increase profit margins and shareholder returns businesses try to minimise pay rises for employees, especially labourers. In order to protect employees from exploitation the government introduced minimum wage laws. These laws specify the lowest wage an employer can pay its employees and therefore protects the rights of workers and guarantees them a minimum standard of living. The Retail Award provides minimum wage levels for sales assistants and other people working in the retail industry. The award provides minimum wages for eight categories of workers. For example the minimum wage for a level 8 retail employee is $740 per week and covers previous store managers and level 5 clerical officers. The award also covers annual leave and sick leave entitlements as well as other word related entitlements.

To implement a floor price, the government must first decide on whether or not a floor price should be used, what the floor price should be, how they will deal with the side effects, over what period of time it is to be introduced and if the benefits outweigh the consequences. When used floor prices can cause significant side effects in the economy, because of this it is imperative for the government to carefully decide if there is another way to achieve their goals.

The effects of floor prices on the market are extensive and are both positive and negative:Gives producers a guaranteed minimum return and standard of living.

Prevents worker exploitation from business cost cutting and provides them with a guaranteed minimum income and standard of living.

By artificially increasing the price of a good the government decreases demand as consumers decide to purchase less of that product, or are forced out of the market. This means that consumers are purchasing less than the market equilibrium.

As producers are now guaranteed a higher price they are willing to supply more of a good than the market equilibrium.

With consumers demanding less and producers producing more, a surplus is created. If the surplus is allowed to remain in the market there is a chance that the price will drop below the market equilibrium, as producers try to offload the surplus.

A floor price for a particular agricultural product can cause a deficit in the supply of other agricultural products as producers are more inclined towards supplying the product with the floor price.

If minimum wages are higher in Australia than in overseas countries it may cause job losses in Australia if businesses outsource this work overseas.

A floor price causes a surplus of goods to be produced, the government must find a way to remove this surplus.

The government can buy the entire surplus and either gives it to other countries or attempts to sell it on international markets that are not producing enough.

The government can enforce the floor price and let the surplus go to waste, this means that some suppliers who are unable to sell their goods will be far worse off compared to suppliers who can sell theirs. Minimum wage laws for example cause producers to reduce the amount of employees they hire meaning that some workers who are willing to work for less than the minimum wage do not get to work at all.

The government can control how much is produced, by giving out production rights the government can control how much is produced in a market. If the government implements production rights as a measure to control surplus it can lead to corruption bribery and in extreme cases price fixing can occur.

The government can subsidise the cost of the goods to increase demand and cause more of the surplus to be consumed. This adds a significant cost to the governmentÃÂs budget.

A price floor can, if not used sparingly or properly can cause a total collapse in a market and enormous problems in the economy. If a large surplus of a good is produced because of a price floor the producer will try to find a way to sell it at a lower price as they cannot sell it at the market price, this will in certain circumstances cause the price to drop very fast and possibly drop to below the market equilibrium price defeating the purpose of the floor price and causing possible market instability.

Bibliography:Anthony S. Rachel M. Sue S. Andrew S. & Edmund E. 2006, Economics Preliminary, Cambridge, MelbourneAustralian Retailers Association, 2009, Promoting & protecting retailers, viewed 17/5/09http://www.retail.org.au/index.php/employment_relations/award_modernisationThe Smartacus Corporation, 2009, Government Intervention: Price Floor, Viewed 17/5/09http://www.college-cram.com/study/economics/presentations/635