Introduction:Since 1972, Dufey's (Dufey, 1972) finance theory has adopted that firms' value could be affected by foreign exchange rate risk. But Jorion's (Jorion, 1990)analysis in 1990 generated counterintuitive result. Due to this conflict, lots of studies are focused on the relationship between firm value and exchange rate risk.

With the increasing globalization activities, the foreign exchange rate risk becomes an important part management may have to think about. Based on the survey data by Bodnar from 1995,( Bodnar, Hayt, Marston and Smithson, 1995) foreign exchange rate risk seems closely related to firm cash flows volatility. In 2001, Allayannis and Ihrig's theory (Allayannis and Ihrig, 2001) suggested that firm cash flows volatility is determined by the nature of firms. But because it's difficult to analyze most firms' cost structure, this way didn't figure out the relationship successfully. Even different studies are applied; the empirical evidence we got is still too weak to support this opinion till now.

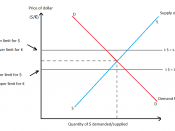

In 1999, the Euro is introduced as a common currency used among Europe countries. It's a hypothesis that a common currency could reduce transaction costs, and exchange rate risk. (Jurgen schrempp, Newsweek Special Issue 9/1998-2/1999) It's because the trade across countries avoiding the dealing of foreign currencies, then both of traders do not suffer the unexpected foreign exchange rate changes. The transaction cost occurred during the dealing of foreign currencies is eliminated as well. Then the relationship between foreign exchange rate and firm value could be observed through examining the affect of Euro on firms to check whether this hypothesis is feasible.

In order to do so, there are three points need to be proved:After the launching of Euro, for many countries, stock market volatility increases. Compared to non-Euro countries and outside of Europe, those firms within Euro area due to higher exposure of...