Profit and Loss

Most businesses go into business to make money. A business cannot survive for very long unless it earns a profit

Profit is the increase in Owners Equity that results from the successful operation of a business

Businesses earn profits by sellings goods (tangible items that one can touch, etc.) and services (e.g. Law consultation, haircuts, gyms, clubs, etc.)

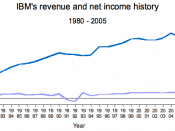

Revenue is amounts earned from the sale of goods or services during the routine operations of the businesses.

Expenses are the costs of items or services used up in the routine operation of the business.

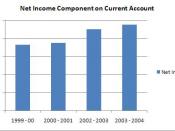

Net Income is the difference between revenue and expenses when revenue is greater than expenses.

Net Loss is the difference between revenue and expenses when expenses are greater then revenue.

The Income Statement

The income statement is a financial statement that presents the revenue, expenses, and net income/loss for a specific period of time.

The accounting period is the period of time covered by the financial statements.

There are 4 steps in preparing an income statement.

1) Prepare Statement Headings

- Who? Business or Person's Name

- What? Income Statement

- When? For the period ended

2) Prepare Revenue Section

3) Prepare Expenses Section

4) Determine Net Income or Net Loss

GAAP; Time Period Concept

This time-period principle requires the definition and use of the same period of time for the accounting period

This allows accountants to produce accurate and consistent financial statements.

Equity Relationships

R - E = Net income/loss

C+ (R-E) - D = OE (Owner's Equity)

A = L+OE

A = L + (C+(R-E)-D)