Deborah N. Freire

ECO 202-001

June 17, 2014

Inside Job

Question 1: What role did the U.S Government played in the making of the financial crisis?

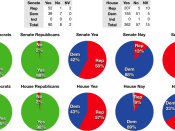

Starting from 1982, the Reagan administration deregulated savings and loan companies, permitting them to make risky investments with their depositor's money. This effect cost taxpayers 124 billion dollars and also cost many people their life savings. Moving from Regan years to the Clinton, deregulation continued and the advances in technology led to an explosion of complex financial products, called derivatives. According to Phil Gramm, they unified markets and reduced regulatory burden. By 2000, Congress passed the Commodity Futures Modernization Act, which banned regulation of derivatives. In addition, Citicorp and Travelers merged, to form Citigroup, which violated the Glass-Steagall Act that prevented banks with consumer deposits to engaging in risky investments. In 1999, this caused congress to pass on Gramm-Leach-Bliley Act to prevent future merges.

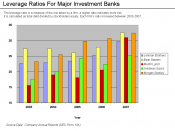

Afterwards, when George W. Bush took office in 2001. Deregulations moves forward allowing the linking of the dominating industries such as Golden Sachs, Morgan Stanley, Citigroup, JP Morgan, etc. created a new system were lenders sold the mortgages to investments banks and they combined thousands of loans to create complex derivatives, called collateralized debt obligations (CDOs). Contrasting from the old system, when homeowners paid their mortgages, the money went to investors from all over the world. This caused lenders to stop caring about borrowers repaying and make risker loans (subprime) and the more CDO's, the higher the profits. Due to lenient regulations for loans resulted in an increase of mortgage loans, allowing more people to own homes leading to the bubble. Investment banks favored subprime loans because they have higher interest rates and during the bubble this created more CDO's. Many home loan borrowers were unable to pay the...