BTX9190 - Assignment 2

PART 1 - Question 1

Obtaining Payment Under Incoterms

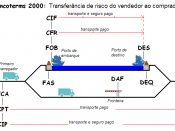

In this case, the trade terms between BTN and Melinoise is Carriage and Insurance Paid to Paris (CIP Paris). If the goods are lost or damaged after the risk passes to the Buyer, the Buyer is responsible. The Seller can demand full payment for the goods. The Buyer must pay the full price of the contract. When does risk passes under CIP? When seller has completed the delivery to the buyer, usually at this point the risk passes to the buyer. Under CIP incoterms A4, seller deliver the goods and therefore the risk passes when seller pays for contract of carriage to named destination (Paris) and delivers to goods safely to suitable carrier (or first suitable carrier) in accordance to the incoterms A3. BTN as a seller has completed the delivery to the carrier and has contract on usual terms at his pown expense for the carriage of the goods to the agreed point at Paris by a usual route and in a customary manner (Incoterms CIP A3(a)) and also is assumed to have obtained at his own expense cargo insurance as agreed in the contract (Incoterms CIP A3(b)) from the fact given that there is insurance contract included in the documents sent by BTN to Meniloise.

According to Incoterms CIP B5, as seller has delivered the goods in accordance to A4 (deliver the goods to the carrier), the buyer will bear the all risks of loss of or damage to the goods. As the risk has passed to the buyer and in provision of contract of carriage (Incoterms CIP A3(a)), the buyer must pay for all costs relating to the goods from the time they have been delivered and therefore the seller can claim full payment...