Table of Contents A.1. Size and Growth 1 A.2. Major Players 1 B. SERVICES 2 Corporate Finance: 2 Fixed Income and Equities: 2 Others: 2 C. END USERS 3 D. EXTERNAL ENVIRONMENT 3 E. INDUSTRY ANALYSIS 4 F. CONCLUSION 5 EXHIBITS 6 Exhibit 1: Rankings of Investment banking firms on fixed income trading 6 Exhibit 2: Ranking of the firms based on assets. 7 Exhibit 3: Ranking of firms based on Market cap 8 Exhibit 4: Layoffs in 2001 8 BIBLIOGRAPHY 9 A. INVESTMENT BANKING: AN OUTLINE Investment Banking is the term used for institutions that specialize in any of the following functional aspects in the financial market: ÃÂ÷ Mergers and Acquisitions and related long-term strategy.

ÃÂ÷ Raising capital for firms through IPOs or through issues of corporate debt .

ÃÂ÷ Dealing with strategies relating to foreign exchange requirements of firms.

In addition Investment Banks also trade in the stock and bond markets, provide retail brokering services and research reports for investors, manage assets of high net worth individuals and act as venture capitalists in select areas of interest.

The centers of this sector are the well-developed capital markets like New York, London, Tokyo, Frankfurt and Hong Kong.

A.1. Size and Growth The year 2000 was a boom period for Investment Banks with revenues in excess of 150 billion US dollars with records set on incomes generated through Mergers and Acquisitions and IPOs, which are typically the most lucrative activities. Firms raised $80.5 billion in IPOs, up from $68.7 billion in 1999 and engaged in $1.8 trillion worth of M&A activity, up from $1.6 trillion in 2000 . But the slump in the past year has seen revenues drop by almost 30%.

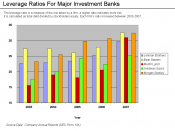

A.2. Major Players The industry is split into : Bulge bracket firms, which include multi-billion dollar...