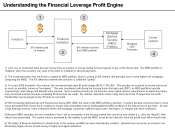

The Return on Equity is a measure of efficiency with which a company employs owners' capital. P 0.195 is earned for every peso of invested equity capital or there is 19.5% return to owners on their investment. The ROE is composed of a low profit margin, high asset turnover and high financial leverage.

Jollibee has a low profit margin (0.0581) in relation to its high asset turnover (1.75). The profit margin reflects that for each Peso of sales, 5.8% goes to the company as profits. The asset turnover, on the other hand, conveys that 174.9% of sales were generated from each dollar of assets employed. From the low profit margin and high asset turnover, it can be deduced that Jollibee adds little value to their product. This is apparent in their order-at-the-counter, pay-as-you order, and self-service scheme. Hence, their products require fewer assets.

The company has a high financial leverage (1.92),

which means that it used a large proportion of debt relative to its equity to finance the business. Jollibee has an inventory turnover of 16.9 and its typical item sits in inventory about 22 days before being sold. The average time lag between sale and receipt of cash from sale is 22 days. It has a current ratio of 1.07 and an acid-test ratio of 0.853. The company has a times interest earned ratio of 48.2. It is able to meet the annual cash payment the debt requires. It can be inferred form the inventory turnover, collection period, current ratio, acid-test ratio and times interest earned ratio that Jollibee has a highly predictable and stable operating cash flow. Jollibee's major product is food, a basic need, coupled with its reputation of being one of the giants in the food service industry; the company therefore faces a high degree...