The week 4, University of Phoenix "Monetary Policy" simulation was competed and this paper will summarize the concepts presented. This will include a description of the tools used by the United States Federal Reserve to control the money supply and how each influences the money supply and subsequently, macroeconomic factors. It will discuss how money is "created" and will conclude with a discussion of how the monetary policies can be combined to best achieve an acceptable balance between economic growth, low inflation and a reasonable rate of unemployment.

Tools Used by the Federal Reserve to Control the Money SupplySeveral key tools are described in the "Monetary Policy" simulation. These include the discount rate and its relationship to the federal funds rate, the required reserve ratio, and finally open market operations. The discount rate is controlled by the Federal Reserve (the Fed). McConnell & Brue describe the discount rate as the interest charged by Federal Reserve Banks on loans made to commercial banks.

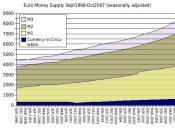

(2005, p. 274). This is in contrast to the federal funds rate, which is the interest rate charged by banks for loans made to other banks. The required reserve ratio is the percentage of the deposits that any bank must hold as reserves and is determined and set by the Fed. Finally the term "open market operations" refers to treasury bills, government bonds, and other Federal financial instruments that are sold by the Federal Government to investors. Together, these are various tools used by the Fed to control the money supply of the United States economy.

How the Tools Influence the Money Supply and Macroeconomic FactorsThe Fed uses the tools described in the last section to control the supply of money in the economy, which, in turn, affects macroeconomic factors such as gross domestic product and the inflation...

Well Writen Paper!

Paid great attention to detail and very helpful!

0 out of 0 people found this comment useful.