Divisional hurdle rates at Marriott have a significant impact on the firm's financial and operating strategies. Marriott measures the opportunity cost of capital for investments of similar risk using the Weighted Average Cost of Capital ("WACC"). The scope of this analysis is to assist Marriott in selecting the appropriate hurdle rate for each division as of April 1988 ("Valuation Date"). As the risk entailed in each division is different, Marriott should discount divisional projects at the division's hurdle rate. In order to select the appropriate hurdle rate, the WACC of each division and of the company as a whole are calculated and used as a proxy for the divisional and corporate hurdle rates.

WACC AnalysisGeneral ConsiderationsThe following steps were taken to calculate the WACC of each of the divisions and for Marriott:1) We used the Capital Asset Pricing Model ("CAPM") to calculate the cost of equity.

2) The cost of debt was determined by adjusting the pre-tax return on debt capital for the tax benefit associated with the deductibility of interest on debt3) The appropriate market value weights for debt and equity as a percentage of the market value of invested capital were applied to the cost of equity and the cost of debt to determine the corresponding WACC.

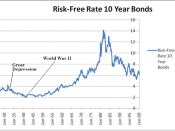

The rationale for some inputs was common:(1) Risk Free Rate: We believe the most appropriate risk free rate to use for the cost of capital of Marriott and its divisions is the rate that corresponds with the expected economic life of each project. Since Marriott and the Lodging Division both have projects with economic lives longer than 10 years, we used the 30 yr. U.S. government interest rate as of the Valuation Date. Because the other divisions (contract services and restaurant) have project lives around ten years, we used the...