MERGERS AND TAKEOVERS 1) What different types of mergers are there? A merger is the joining of two firms with the approval of the shareholders or the management concerned.

Vertical mergers: Vertical integration is when the firms that are merging are along the same supply chain but they are NOT on the same level. It is vertical in the way that the companies merge up or down the production process, i.e. from raw materials to distribution. For example if a coffee manufacturers (in the secondary sector) merges with a coffee plantation (in the primary sector).

The oil industry is a key example of an industry that operates under vertically integrated companies.

Horizontal mergers: This is when the merging firms produce the same kind of good or service. In recent years there have been a high number of mergers of this sort in the communications banking pharmaceuticals and motor industries some examples are: ÷ Daimler-benz and Chrysler ÷ NationsBank and BankAmerica ÷ Astra and Zeneca Conglomerate mergers: These are firms, which merge but have no direct link, for example I firm who produces cigarettes may merge with a company that produces ice cream.

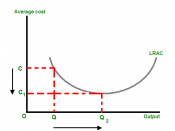

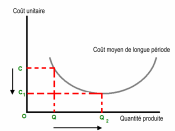

2) Why would one company wish to takeover another company? The motives, which cause a firm to grow in size, are many and complex but there are three main and obvious ones: ÷ The desire to achieve economies of scale ÷ The desire to achieve a greater share of the market and resultantly greater market power ÷ The wish to achieve greater security by extending the range of products and markets.

Motives for vertical integration (takeovers) An important motive for this type of takeover is the desire to secure an adequate number of market outlets with the desire to raise the standards of these outlets, giving security and...