Central banks act systematically to changes in economic conditions and set interest rates

Money demand fluctuates because income fluctuates

If money demand is too high interest rates are increased to lower it and if too low interest rates are lowered to increase it again.

This helps to keep the nominal money stock on a specified task and stabilises aggregate demand for output.

Taylor Rule

This implies that banks don't follow the monetary target but the intermediate targets of inflation and output.

IS Schedule

- Concerns the goods market

- Shows different combinations of income and interest rates at which the goods market is in equilibrium

- The goods market is in equilibrium when aggregate demand = actual income

The LM schedule

- Concerns the goods market

- Shows different combinations of income and interest rates at which the money market is in equilibrium.

- The money market is in equilibrium when the DEMAND for real money (L) = actual SUPPLY of money (M).

- Interest rates rise and fall in order to keep L & M in line with each other

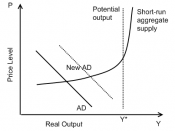

Shifts In IS Schedule

Anything other than interest rates that affect aggregate demand will cause shifts in the demand schedule.

Upward shifts:

- Higher expected income will raise consumption demand

- Higher government spending adds directly to AD

- Given interest rates will encourage investment demand.

Shifts In LM Schedule

LM schedule reflects the given money policy so a shift in this will usually be due to a change in policy.

Higher Monetary target:

An upward shift in the LM schedule because if money supply increases money demand must move in line with it. Leads to higher output and interest rates.

The IS-LM Model

The IS LM model allows us to view both the goods and money market in...