Once a upon a time we lived in a robust economy with high growth rates and exceptionally high stock prices. Internet and Technology companies became the trend in 1999 and Wall Street rewarded them and their investors generously. Company stock prices soared based on speculation; not just well established companies, but start up companies as well. 428 companies held Initial Public Offerings in the first ten months of 1999 and 75% of them were technology-related (Petruno 1). The average I.P.O soared an astounding 57% on the first day of trading, and we thought there was nothing suspicious about companies being valued in the billions of dollars when they didn't have a dime in profits.

We, the champions of the economy, thought nothing, not even G-d himself, could hamper the direction of the stock market. It was not long ago that economists and financial advisors alike predicted the Dow Jones to reach and exceed 15,000.

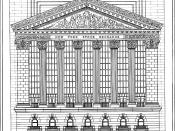

The Nasdaq was well on its way to 10,000. However, something bad happened in the middle of this mess. The stock market became clearly divided between "new economy" stocks and "old economy" stocks. The "new economy" stocks belonged almost entirely to the Nasdaq, which explains the lopsided growth of 1999. Michael Murphy, editor of The California Technology Stock Letter noted "The Standard and Poor index managed to gain 19.5% in 1999. Nasdaq rocketed 85.6%. Yet 68% of stocks traded on the New York Stock Exchange were down for the year" (Murphy 11). Murphy as well as myself, believe that the entire stock market is being supported by just a handful of Internet/Technology stocks. But more importantly, this handful of stocks are guiding the direction of the economy as a whole. These Internet/Technology "new economy" stocks are believed to be capable of having a significant impact on...