This memo is a suggested cost structure regarding to the contract with Montana Power. After my

calculation, I discovered the perfect cost structure is to generate some power internally and buy

some power externally, with 190 megawatts (rounded) generated from PPL's hydro facilities in

Montana, 87 megawatts (rounded) generated from PPL's J.E. Corette Plant, as well as buying

223 megawatts (rounded) from other generators in the spot market.

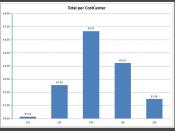

After analyzing the total cost structure in figure 1, I saw that at a specific point, such as around

200, the cost of both PPL's hydro facilities' cost increase significantly. Though PPL's hydro

facility and Corette plant had more than enough capacity to meet the 500 megawatt capacity,

producing all power internally will lead to a significant increase in total cost. So John

Chamberlain could be wrong about refusing to buy power from spot market.

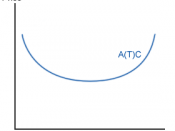

The method I used was a Lagrangian analysis of the total cost base on the cost function

Rodriguez provided, assuming her cost estimates were right. First of all, I combined the total cost

equation,

ðð¶ = 1000 + 0.09ð¥2 + 0.15ð¦2 + 6ð¦ + 0.02ð¥ð¦ + 36ð§, subject to ð¥ + ð¦ + ð§ = 500, ð¥ <

476, ð¦ < 227.

Because we didn't want to fail the contract as well as waste any power. In order to get the

minimum total cost, I set up a Lagrangian function:

ð¿ðð¶ = 1000 + 0.09ð¥ 2 + 0.15ð¦2 + 6ð¦ + 0.02ð¥ð¦ + 36ð§ + ð¾(ð¥ + ð¦ + ð§ â 500),

ð¤âððð ð¥ < 476, ð¦ < 227.

Then the best combination is ð¥ = 190.30, ð¦ = 87.31, ð§ = 222.39, ð¾ = â36, where the total cost

is minimum at $14264.93. The result matches perfectly with the one I...