Robert Mondavi Company is using bonds to collect capital for its new developments. Robert Mondavi was issuing bonds many times in different quantities and every issue has different coupon rate, only some of them are callable as well as different issues have different maturities.

To demonstrate how bond refunding can works and how company can save money and improve its cash flow I used assumptions provided in our instructions and I also accepted that Robert Mondavi has only one bond issuance that has 10% call premium, 10% coupon rate and 20 years maturity.

To calculate if the company should refund its bond debt we need to find out how much would be the cost of calling the old bonds, how much would be the cost of the new bonds. When we know how much would company have to spend on those operations and how much would be the saving from bonds with the smaller coupons we need to compare those numbers and then we can say if there is a chance that the company could save on refinancing.

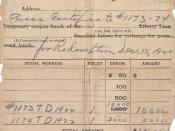

When we calculating operation of recalling old bonds and issuing new bonds we can start from the call premium which would be probably the biggest expense. In our case call premium is 10% therefore Robert Mondavi will need to pay $31,617 however it need to be adjusted with tax since it is deductible expense. After adjustment we learn that RMC will pay $18,970 as a call premium. Another cost of this operation is flotation cost of the new issue and that is 5% what gives us $15,808 but this time it is not deductible. Next, we need to calculate immediate savings on old flotation cost expenses and that will improve our cash flow and it will be showed as an after...

![Robert Mondavi Winery, Napa Valley, California. Located in Oakville, California, the Mondavi Winery was built in 1966 and designed in the California mission-style. [1]](https://s.writework.com/uploads/8/80805/robert-mondavi-winery-napa-valley-california-located-oakvill-thumb.jpg)