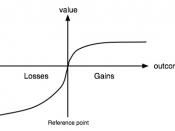

Prospect theory is an important deviation from normative behavior because it describes a wide range of choices under uncertainty. Most choices people make are under varying degrees of uncertainty, since no one can ever have perfect knowledge of a situation. Prospect theory further demonstrates that humans are inherently poor with probabilities and that people can have intransitive preferences because they view each situation as a gain/loss rather than a change from state of wealth to another. When given a choice between getting $1000 with certainty or having a 50% chance of getting $2500 people may well choose the certain $1000 in preference to the uncertain chance of getting $2500 even though the mathematical expectation of the uncertain option is $1250. This is known as risk-aversion. But Kahneman and Tversky found that the same people when confronted with a certain loss of $1000 versus a 50% chance of no loss or a $2500 loss do often choose the risky alternative.

This is called risk-seeking behavior. This example demonstrates the asymmetry of human choices and the preference for risk-seeking behavior when dealing with a loss and risk-aversion when dealing with a gain.

People focus on gains and losses to calculate expected utility of outcomes. They are risk adverse for gains and risk seeking for losses. As shown in the previous example, people are more ready to take a gamble to avoid a loss than take a sure loss, and people would rather take a sure gain than take a gamble for a higher gain. Individuals do not assess risky gambles following the precepts of von Neumann-Morgenstern rationality. Rather, in assessing such gambles, people look not at the levels of final wealth they can attain but at gains and losses relative to some reference point, which may vary from situation to situation. People...