Q1. Comprehensive analysis of CML's Resource Profile (PERTH)

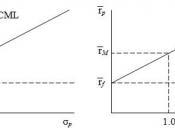

Financial resources (Financial Ratios& Du Point): For Performance analyse, CML has a decreasing trend on Profit margin , ROA, and ROE. This implied CML's ability to generate profit has fall. ROE has declined significantly due to 50% reduction on OPAT , but they were relatively stable during 97-00. In 2001, the Asset Turnover rate has slightly decreased as a result of drop of cooperation efficiency. EPS has also decreased from 99-01 due to weak demand, poor post-Christmas clearance sale and customer's dissatisfaction. For the Financing analyse, the decrement of Equity Multiplier has shown CML is mainly using debt to finance its investments in the last five years. But as D/A, D/E and leverage ratios (Appdendix1) in 2001 were the lowest within the last five years, it has indicated the reliance on debt has decreased. The major financial strength of CML is the relatively high interest coverage ratio, which has enabled the company to have a good credit rating for high borrowing capacity.

For Liquidity and Solvency analyse, the current ratio and quick ratio of the CML were increasing and above 1 in the past five years. Even though, this implied CML has sufficient cash flow in meeting its short-term debt, the ratios were still considered to relatively low because of CML significant amount of current liabilities. One of the financial weaknesses is the relatively low quick ratio, it indicates the tendency of building up excessive amount of inventories.

Physical resources: CML has predominantly traded under many leading department stores with continuous acquisition of capital and take over, such as Franklins. It owns around 2000 stores in Australia and New Zealand together with an e-commerce business. There is significant amount of highly specialized fixed equipments in Tyres and Auto stores, which is hard...