INTRODUCTION This report is about the financial analysis of two retail companies, Monsoon Plc and J Sainsbury Plc. The aim of this report is to compare both companies against each other to find out which company is doing better then the other. This report will start off with Monsoon?s two years financial report and followed by Sainsbury?s two years financial report and the conclusion will be on which company doing well and why is it doing well. The financial ratio analysis comprises of four parts, which are as follows (Gowthrope, 2003): i. Performance Ratios ÷ It is used to assess the relative success or failure of business performance.

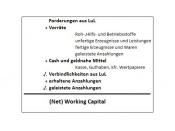

ii. Working Capital Efficiency Ratios ÷ It is used to assess the extent to which asset and liability items are well utilised and well managed.

iii. Investment Ratios ÷ It is used to assess various items of particular interest to investors.

iv. Financial Status ÷ It is used to assess the extent to which a business can comfortably cover its liabilities.

These ratios will be used to calculate how both companies are performing.

MONSOON PLC Monsoon, which specialise in women?s clothing and fashion accessorise is a design ? led retailer. Peter Simon founded the company in 1972. The company also operate with another name, Accessorize, which deals with ladies fashion accessorise. Monsoon provides its customers with product differentiation and customer service by recognising its people, particularly its continuing ability to inspire, motivate and reward them. When Monsoon was first opened it focused on clothes with ethnic origins mainly from Malta and Far East and in 1984 an exciting and strongly differentiated high street concept for fashion accessories was introduced when Monsoon created Accessorize.

The followings are the financial ratio analysis for Monsoon: i. Performance Ratios a. Return on Capital Employed (ROCE) Profit...

Add

if you can add the balance sheet ,financial statement,cash flow statement it could be more clear.

0 out of 0 people found this comment useful.