American Healthways and Renal Care Group, Inc.

An in-depth review of any corporation's financial status would be seriously remiss without the inclusion of a definitive look into their ratio analysis and cash flows. This form of financial analysis has come a long way with the advent of modern technology that incorporates advanced software accounting programs that can provide instantaneous and accurate feedback. As Kevin Ahlgrim mentions in his article in the Journal of Risk and Insurance, "financial analysis has become more important than ever (2004)!" Kevin was referencing the book written by Gary Giroux and indicating how in the past with little data available many company managers had to simply rely on their "gut instincts" to formulate an accurate decision-making process (Ahlgrim, 2004). The increased activity that today's businesses generate and the fact that many of these activities are now available for scrutiny on various World Wide Web portals, allows all forms of interested parties the opportunity to form their own analysis of a company's "financial health."

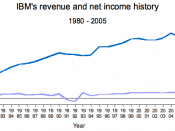

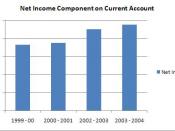

By using this information, companies can make informed and accurate decisions with regard to individual and group investment strategies. This paper will look into the ratio analysis and cash flows of American Healthways and Renal Care Group, Inc. and answer some valuable questions about their own financial status. We will review the statement of cash flows of both companies and determine how much cash was generated by operating, financing, and investing activities (passive). We will then address how significant internal events affected each company's financial "cash" status and discuss the changes in revenues and net incomes for the past three years. This will lead us to a series of ratios that will help us determine each company's solvency, liquidity, and profitability. The ratios this paper will cover are current ratio, sales ratio, earnings...