1. Introduction

The relationship between money supply and inflation rate is considered to be controversial and debatable economic topic, which has been subject of examination for various research studies. Consequently, numerous conclusions and perspectives have been presented regarding the nature of the relationship and its degree of correlation.

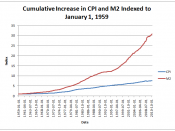

This paper examines the key issues between money supply and inflation. Initially, thorough description for each variable is given, which is further elaborated by employing the core monetary theories to interpret and justify the relationship. Afterwards, empirical studies with different and contradicting conclusions are discussed. Moreover, empirical analysis is performed by running a standard regression. Its purpose is testing the degree of correlation between the growth rate of money in period t-1 and inflation in period t. For the regression analysis data for United States has been used, concerning a 29-year period. In the end, conclusions are drawn based on the results' interpretations, which are then compared to the reality and the theory.

2. Money Growth

Money is considered to be anything commonly accepted as a final payment in exchange for goods and services. In addition, it is found to have four main functions: means of payment, store of value, unit of account and most essentially medium of exchange (Edgmand et al., 2001). Money is not constant and absolute; therefore its perception greatly varies among the economists, mostly based on personal judgment.

By being the most liquid asset, money's purchasing power is largely determined by the money demand and supply, and as well by the velocity of circulation (the speed with which money changes pockets).

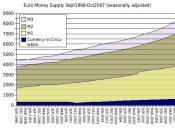

One arguable issue is the defining of money supply beyond being only the cash in circulation outside banks plus bank deposits (Solow, 2004). Thus, there are three definitions of money supply. M1, or the narrow definition of...

Cool Essay

Very good job writing this essay.

0 out of 0 people found this comment useful.