Recommendation of allocation of investment money

Executive Summary

The report recommends that AMPL invest $100,000 in Super Cheap Auto. The company is likely to grow and pay dividends and is a continuing investment. Pacific Brands would be a poor investment due to its current restructuring and large debt, and Harvey Norman has had a recent decrease in profits and has little working capital. Although a charitable donation would result in a large tax reduction, the outlay of the gift would be too large an amount to recoup from the marketing benefits of making a charitable donation.

�

Table of Contents

Executive Summary page 1

Introduction page 3

Analysis page

Pacific Brands page

Harvey Norman page

Super Cheap Auto page

Charitable Donations page

Conclusion page

Reference List page

Appendix page

�

Introduction

This business report is written by the asset investment team for Accounting Managers Pty Ltd 'AMPL' in response to a recent review of the 2010 cash budget which suggested a sustained surplus of $100,000.

The report addresses where best to allocate this money.

The report assesses three public companies; Pacific Brands, Harvey Norman and Super Cheap Auto as possible investments. The report also considers whether some or all of the money should be allocated to charity. In doing so it weighs up whether the benefits of donating to charity are worthwhile.

This information is provided as a basis for recommending the best possible way for AMPL to allocate the funds.

�

Analysis

Public Companies

Pacific Brands

Financial Analysis

Basic Financial Information

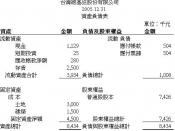

Balance Sheet

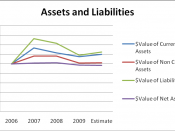

$ Value of Assets | $ Value of Liabilities | $ Value of Equity | |

Raw numbers from the 2009 Balance Sheet (consolidated entity) | 2 225 495 | 958 442 | 1 267 053 |

Raw numbers from the 2008 reports (consolidated entity) | 2 846 392 | 1 156 304 | 1 336... |