Net Present Value (NPV) is a way of assessing the value of a potential investment. This takes the future net cash flows and discounts them by the required rate of return that is needed. If the net present return is still positive then the project is giving the required rate of return. (Horngren, Sundem, Stratton, 2005) In the case given with Deer Valley Lodge we first need to calculate the cash inflows and outflows it will generate. The first consideration is the costs involved.

Figure 1. Initial Investment.

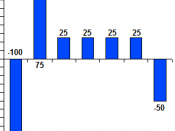

Chair lift (a)2,000,000Slope preparation (b)1,300,000Total initial investment (a + b)3,300,000Figure 2. Running Costs.

Running costs per day (a)500Number of days (b)200Total running costs (a x b)100,000Here we are assuming that the lift will run for the full 200 days, even though there is only value added for the 40 days when there is insufficient capacity on the current lifts.

Now we need to look at the profit it will generate.

First we will look at the gross profit per ticket.

Figure 3. Gross Profit per Ticket Sold.

Ticket price (a)55Variable cost (b)5Net cash flow per ticket (a ÃÂ b)50Now with the number of tickets to be sold and the days open, we can look at the income and then use that to calculate the net cash flow per year.

Figure 4. Net Cash Inflow per Year.

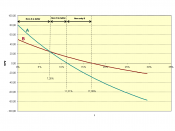

Extra capacity created (no of tickets) (a)300No of days the capacity will be used (b)40Total tickets sold for new lift (a x b)(c)12000Net cash inflow per ticket (d)50Net ticket receipts (c x d) (e)600,000Running costs (f)100,000Net cash inflow per year (e ÃÂ f)500,000Now we can use this to calculate the net present value. We are told the required pre-tax rate of return is 14% and that the lift will have a 20 year lifetime. This...