Firms should invest in proposals that generate maximum value for the company and its shareholders. Financial managers and CEO's should invest in a project that is worth more than the cost of the project. The chosen project should be the one that results in a higher Net Present Value (NPV), which is the difference between the project's value and the cost. This paper will discuss capital budgeting for Silicon Arts, Inc (SAI) and the inherent risks associated with the investment decision-making. Additionally, valuation techniques for the internal and external investment strategies will be discussed.

Capital BudgetingThe financial analyst at SAI was provided with two capital investment proposals that were prepared by a task force set up by company Chairman, Hal Eichner. The investment goal was to increase market share and keep pace with technology. SAI is a 4-year-old start-up firm generating 70% of sales in North America, 20% sales in Europe, and 10% of sales generated in Southeast Asia.

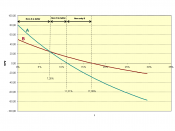

SAI has growth plans and wants to pursue introducing new product lines. The firm's sales turnover is $180 million from manufacturing "digital imaging integrated circuits that are used in digital cameras, DVD players, computers, and medical and scientific instruments" (Scenario, 2008). The analyst evaluated two mutually exclusive capital investment proposals and made recommendations to the CFO, Kathy Lane, to select the project that generated the highest NPV. To determine the proposal that generated the maximum value for the SAI and its investors, the analyst reviewed market research data, forecasts, estimated future cash flows, competition, and cost estimates and determined the NPV and the Internal Rate of Return (IRR). "The IRR is the rate that causes the NPV of the project to be zero" (Ross, et. al., 2004, p.152).

The Dig-image proposal is to expand the existing digital imaging market share, which...