Risk Analysis on Investment DecisionSilicon Arts Inc. (SAI) is a four-year-old company that manufactures digital imaging Integrated Circuits (ICs) that are used in digital cameras, DVD players, computers, and medical and scientific instrumentation. It has presence in North America (70% sales), Europe (20% sales) and South East Asia (10% sales). SAIÃÂs annual sales turnover is $180 million. With the semiconductor boom of 2000, SAI grew by 78%. However, the company experienced a 40% reduction in revenue with an industry slowdown the following year. SAI reduced its costs and froze capital expenses in response to the decreased revenue. SAI positioned itself to respond to an industry upturn by continuing their research and development efforts and developed the IC 1032 specialty chip. With this strategic move and the industry gain in momentum, SAI has experienced recent revenue growth. With this growth, SAIÃÂs is able to pursue the companyÃÂs two-point agenda for the company: Increase market share and keep pace with technology.

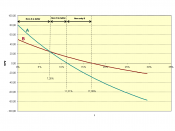

This body of work will examine two potential capital investment proposals, Dig-image and W-comm, prepared by a task force championed by the SAI chairman, Hal Eichner. In the course of this examination, a comparison of Net Present Value (NPV), Internal Rate of Return (IRR) and Profitability Index (PI) between the two mutually exclusive capital investment proposals will be performed. To begin a brief overview of each proposal will be given.

Dig-imageSAI is considering the construction of a new Sunnyvale, CA plant to increase its production base of the Digital Imaging semiconductor. This comes on the heels of a recent worldwide study that has shown a market growth of 20% in year 1 and an annual growth of 7% from year 2 onward, with a cap in year 5 as new technologies are anticipated to replace the Digital Imaging semiconductor. The capital...